Aluminium chloride (AlCl₃) is a vital industrial chemical, widely recognized for its role as a catalyst in Friedel-Crafts reactions in the chemical and petrochemical sectors. It is also used in pharmaceuticals, dyes, lubricants, and the manufacture of aluminum metal. With increasing global demand, shifting raw material prices, and evolving production capacities, monitoring the Aluminium Chloride Price Trend is critical for manufacturers, distributors, procurement managers, and end-use industries.

In this comprehensive overview, we explore the price movements, historical data, future forecasts, and regional as well as market-specific insights related to aluminium chloride. Additionally, we highlight the tools and resources that enable smarter sourcing and procurement decisions.

Latest Price and News Updates

The pricing of aluminium chloride has seen notable volatility in recent years, driven by factors such as raw material availability (notably aluminium and chlorine), production costs, environmental regulations, and market demand shifts. Real-time updates and news tracking are vital for stakeholders aiming to navigate these changes efficiently.

Recent Market Developments:

Increased demand from the petroleum refining and pharmaceuticals industries is intensifying sourcing competition.

Supply chain disruptions due to transportation bottlenecks and geopolitical tensions have influenced global trade flows and local prices.

Fluctuating energy prices, particularly in energy-intensive regions like Europe and China, are affecting production costs.

Environmental policies and emission controls have imposed additional operational costs on manufacturers.

Request for the Real Time Prices

https://www.procurementresource.com/resource-center/aluminium-chloride-price-trends/pricerequest Click here to access live Aluminium Chloride prices and analytics

Aluminium Chloride Market Analysis

Understanding aluminium chloride’s price behavior requires analyzing both upstream raw material costs and downstream market conditions. The market is influenced by both supply-side and demand-side dynamics, with considerable input from global trade and regulatory policies.

Key Market Drivers:

Chemical and petrochemical industry growth, where aluminium chloride is essential for synthesis reactions.

Pharmaceutical sector expansion, especially in developing economies, where the demand for intermediates is rising.

Aluminum production trends, which directly impact the supply and cost of feedstocks.

Increased adoption of aluminium chloride-based catalysts for sustainable and efficient manufacturing processes.

Key Applications Include:

Catalysts in organic chemical synthesis

Production of aluminum metal and alloys

Manufacture of lubricants and synthetic rubber

Dye and pigment production

Wastewater treatment processes

These end uses significantly affect global aluminium chloride consumption patterns and thereby, its market value.

Historical Data and Future Forecasts

Price history offers valuable context for understanding the cyclical nature of the aluminium chloride market. Evaluating historical data also helps procurement professionals forecast cost trends and structure sourcing strategies accordingly.

Historical Price Trends:

2019–2020: Moderate price growth driven by steady demand from the chemicals sector and low raw material volatility.

2020–2021: Global pandemic disruptions caused inconsistencies in supply and freight logistics, briefly pushing up prices.

2022–2023: Soaring energy prices and increased manufacturing costs in Asia and Europe caused upward pressure on aluminium chloride prices.

Forecast for 2024–2028:

Stable demand outlook from catalyst applications in refining and organic synthesis is expected.

Increased investments in green chemistry and sustainable manufacturing processes may drive demand for aluminium chloride.

Production capacity expansion in Asia-Pacific, especially China and India, may balance out regional price surges.

Potential environmental and regulatory hurdles could limit output in some regions, tightening global supply.

Aluminium Chloride Price Database & Chart Tools

An advanced price trend database and analytical chart system can help organizations forecast procurement costs, evaluate supplier quotes, and identify seasonal or regional fluctuations.

Database Features to Look For:

Real-time and historical price tracking

Interactive charts showing regional comparisons

Import/export parity metrics

Supply chain cost breakdowns (including raw materials like chlorine and aluminium)

Global and regional trend visualizations

These tools provide an edge to buyers, analysts, and sourcing teams when planning or negotiating contracts.

Regional Insights & Market Segmentation

Aluminium chloride pricing can vary significantly based on geography, largely due to raw material availability, energy prices, environmental policies, and industrial demand levels. Below is a regional breakdown of key market trends:

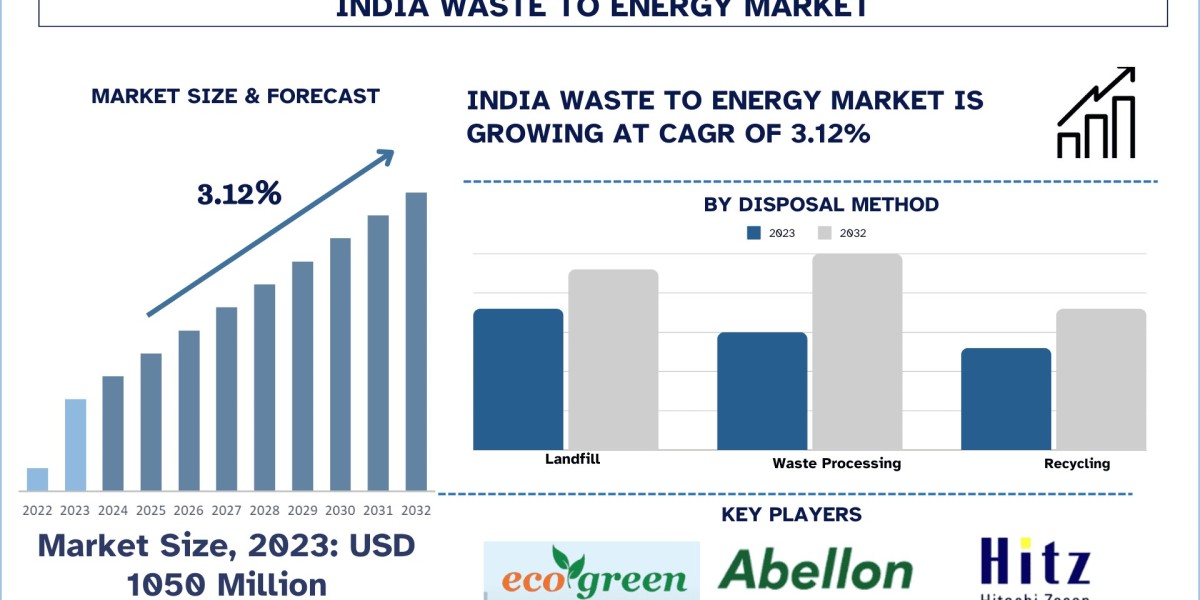

Asia-Pacific

China leads in both production and consumption, driven by its robust chemical manufacturing base.

India’s pharmaceutical growth is boosting domestic aluminium chloride demand.

Environmental restrictions in China have caused intermittent supply disruptions, influencing regional prices.

Cost-competitive manufacturing continues to make Asia a global exporter of aluminium chloride.

Europe

Strict environmental regulations are raising production costs, impacting pricing for both anhydrous and hydrated forms.

Growing demand in specialty chemicals and water treatment sectors keeps procurement active.

Dependence on imports in some areas adds to regional price variability, especially when freight costs spike.

North America

Stable demand across industrial applications, especially in petrochemical and organic synthesis.

Strategic focus on domestic sourcing and lower dependency on imports, supported by shale gas-based feedstocks.

Production consolidation in the U.S. may affect localized price competition.

Latin America

Emerging demand in water treatment and pharmaceuticals is beginning to reshape regional consumption.

Export reliance from Asia and North America, leading to price sensitivity due to currency fluctuations and import duties.

Middle East & Africa

Limited domestic production, with demand largely driven by the refining and chemical sectors.

Potential for future capacity development due to access to cost-effective raw materials like chlorine and natural gas.

Import-dependence results in high logistics-driven pricing variability.

Procurement Resource and Strategic Sourcing

Sourcing aluminium chloride efficiently requires not just price awareness but also an understanding of market timing, supplier capabilities, and contract dynamics. A trusted Procurement Resource offers critical support in navigating these variables through:

Procurement Services Offered:

Price forecasting and cost modeling

Supplier benchmarking and evaluation

Sourcing strategy development

Market intelligence reports and trade data

Customized procurement dashboards

Such tools and consulting services empower procurement professionals to reduce costs, mitigate risks, and ensure consistent supply.

Why Monitoring the Aluminium Chloride Price Trend Matters

Tracking the Aluminium Chloride Price Trend is no longer optional—it is an essential part of procurement and operational strategy. The fluctuations in pricing affect not only raw material budgets but also downstream production costs in multiple industries.

Key Advantages of Price Monitoring:

Cost optimization and budget forecasting

Improved contract negotiation outcomes

Strategic stockpiling during market dips

Early warning signals for supply chain risks

Enhanced agility in supplier selection

Contact Information

Company Name: Procurement Resource

Contact Person: Ashish Sharma (Sales Representative)

Email: sales@procurementresource.com

Location: 30 North Gould Street, Sheridan, WY 82801, USA

Phone:

UK: +44 7537171117

USA: +1 307 363 1045

Asia-Pacific (APAC): +91 8850629517