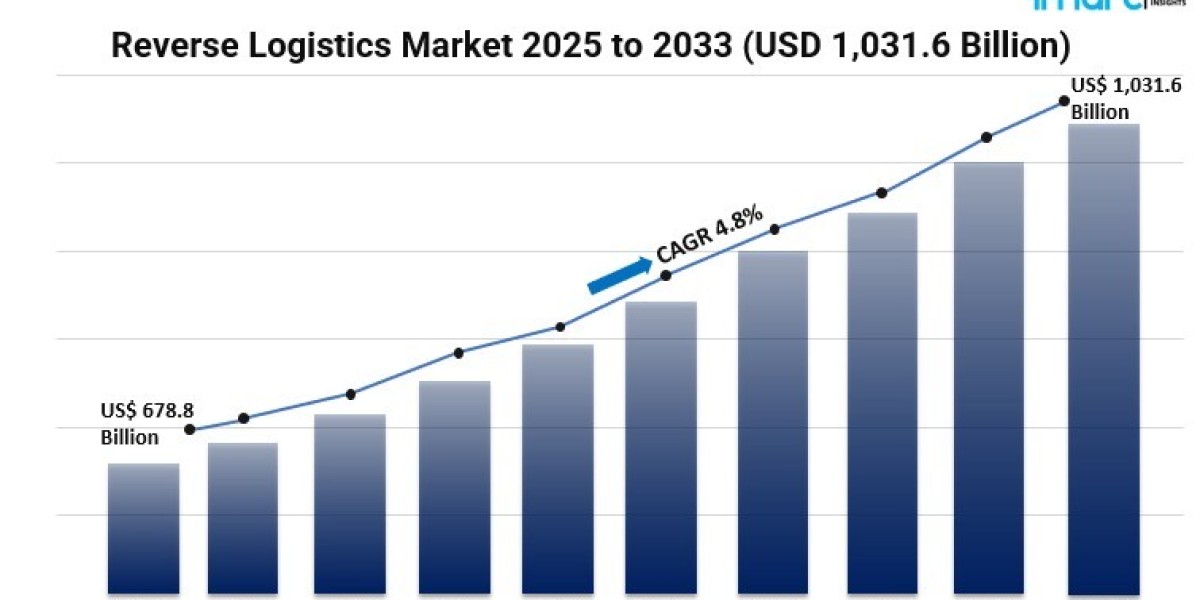

The global reverse logistics market is experiencing significant expansion, fueled by the surge in e-commerce returns, heightened consumer expectations for seamless return processes, and the adoption of sustainable practices. Valued at USD 678.8 billion in 2024, the market is projected to reach USD 1,031.6 billion by 2033, growing at a CAGR of 4.8% during 2025–2033. Key drivers include the integration of advanced technologies like blockchain and IoT, the emphasis on circular economy principles, and the increasing demand for efficient return management systems.

Study Assumption Years

- Base Year: 2024

- Historical Years: 2019–2024

- Forecast Years: 2025–2033

Reverse Logistics Market Key Takeaways

- Market Size & Growth: The global reverse logistics market was valued at USD 678.8 billion in 2024 and is anticipated to reach USD 1,031.6 billion by 2033, exhibiting a CAGR of 4.8% during the forecast period.

- Dominant Return Type: Commercial returns constitute the largest segment, driven by the increasing volume of product returns in the retail and e-commerce sectors.

- Leading End User: The e-commerce sector holds the largest market share, attributed to the growing online shopping trends and the need for efficient return processes.

- Regional Leader: Asia-Pacific dominates the market, supported by rapid digital adoption, expanding e-commerce activities, and robust logistics infrastructure.

- Technological Advancements: Integration of AI, machine learning, and blockchain technologies is enhancing transparency and efficiency in reverse logistics operations.

- Sustainability Focus: Companies are increasingly adopting sustainable practices, such as recycling and refurbishing, to minimize environmental impact and comply with regulations.

What Are the Primary Factors Fueling the Growth of the Reverse Logistics Market?

E-Commerce Expansion and Consumer Expectations

Exponential growth of electronic commerce has resulted in a huge rise in returns of the product, which requires effective reverse logistics solutions. People now expect easy return mechanisms, and companies are thus making heavy investments in strong return management systems. This change not only increases customer satisfaction but also makes people more loyal to their brands. Quicker and effective returns have become a competitive advantage in the business of online retail.

Technological Integration Enhancing Efficiency

The implementation of cutting-edge technologies like artificial intelligence (AI), machine learning (ML), and blockchain is transforming reverse logistics. AI and ML facilitate predictive returns for patterns, minimizing costs and optimizing inventory management. Blockchain provides transparency and traceability in the return process, facilitating stakeholder trust. These technologies are making operations smooth and enhancing overall efficiency.

Emphasis on Sustainability and Circular Economy

Green concerns and regulatory mandates are compelling organizations to implement green reverse logistics practices. By concentrating on recycling, restoring, and remarketing returned goods, organizations are embracing circular economy principles. This not only lessens ecological footprints but also generates additional income channels. Green practices in reverse logistics are becoming a part of corporate social responsibility strategies.

Market Segmentation

By Return Type

- Recalls: Products returned due to safety or quality issues, requiring efficient handling to mitigate risks.

- Commercial Returns: Items returned by customers, often due to dissatisfaction or incorrect orders, representing the largest market segment.

- Repairable Returns: Products that can be repaired and resold, contributing to sustainability efforts.

- End-of-Use Returns: Items returned after their intended use, often for recycling or disposal.

- End-of-Life Returns: Products returned at the end of their lifecycle, necessitating proper disposal or recycling.

By Service

- Transportation: Logistics services facilitating the movement of returned goods.

- Warehousing: Storage solutions for returned products awaiting further processing.

- Reselling: Processes involved in preparing returned items for resale.

- Replacement Management: Handling the exchange of returned products with new items.

- Refund Management Authorization: Processes ensuring accurate and timely refunds to customers.

- Others: Additional services supporting reverse logistics operations.

By End User

- E-Commerce: Online retailers managing high volumes of product returns.

- Automotive: Handling returns of vehicle parts and components.

- Pharmaceutical: Managing returns of medical products, ensuring compliance with regulations.

- Consumer Electronic: Processing returns of electronic devices and gadgets.

- Retail: Brick-and-mortar stores managing customer returns.

- Luxury Goods: Handling returns of high-value items with specialized processes.

- Reusable Packaging: Managing the return and reuse of packaging materials.

By Region

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Which Region Leads the Global Reverse Logistics Market?

Asia-Pacific leads the world in the reverse logistics market today, supported by high digital adoption rates, growing e-commerce operations, and well-developed logistics infrastructure. China, India, and Japan are leading the way, capitalizing on technological developments and growing customer demands to strengthen reverse logistics activities.

What Are the Recent Developments in the Reverse Logistics Market?

The reverse logistics market is seeing enormous progress, with a major boom in technology integration. Firms are embracing AI and blockchain technology to automate returns, increase transparency, and heighten customer satisfaction. There's also an increased focus on sustainability, with organizations embracing green strategies like recycling and refurbishing used products. Such advancements are redefining the reverse logistics ecosystem, making it more efficient and customer-oriented.

Who Are the Key Players in the Reverse Logistics Market?

C.H. Robinson Worldwide Inc., Core Logistic Private Limited, Deutsche Post AG, Fedex Corporation, Happy Returns Inc. (PayPal Holdings Inc.), Kintetsu World Express Inc. (Kintetsu Group Holdings), Optoro Inc., Pitney Bowes Inc., Reverse Logistics Group, Safexpress Pvt Ltd, United Parcel Service Inc., Yusen Logistics Co. Ltd. (Nippon Ysen Kabushiki Kaisha), etc.

If you require any specific information that is not currently covered within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, considerations studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyzes, pricing and cost research, and procurement research.